Fintech and Blockchain in Singapore - 新加坡的金融科技及區塊鏈

Director 指揮 : KEITH YUNXI ZHU 朱耘希

Supervisor 監視 : Jan Olav Fåland 陳天龍

Authors 作者 : Junkai Fang

EXECUTIVE SUMMARY

行政摘要

This report explores the application of blockchain technology and fintech in Singapore. It clarifies the distinction between cryptocurrency and blockchain and outlines how Singapore is emerging as a hub for blockchain technology. The document also addresses the existing regulatory landscape and the difficulties encountered by companies in the sector. Lastly, the report offers perspectives on using non-profit foundations and public limited companies for token issuance and the challenges of liquidity and accounting.

本報告探討了區塊鏈科技和金融科技在新加坡的應用。 它闡明了加密貨幣和區塊鏈之間的區別,並概述了新加坡如何成為區塊鏈科技的中心。 該檔案還談到了現有的監管環境以及該行業公司遇到的困難。 最後,該報告提供了利用非營利基金會和上市有限公司發行代幣的觀點,以及流動性和會計方面的挑戰。

1

Background

背景

Blockchain is a term often confused to be synonymous with cryptocurrency. However, this is not the case. Blockchain technology is a system of recording information that makes it impossible for hackers or other malicious actors to alter the data written on the blockchain. A blockchain is a digital ledger where information is stored not just in one central server but rather across millions of computers worldwide. This is what ensures the immutability of the blockchain.

區塊鍊是一個經常被混淆為加密貨幣同義詞的術語。然而,事實並非如此,區塊鏈技術是一種記錄信息的系統,這種系統使黑客或其他惡意行為者無法更改已寫入區塊鏈的數據。區塊鍊是一種數字分類帳,其中信息不僅僅存儲在一個中央服務器中,而是存儲在全球數百萬台計算機中。這就是區塊鏈不變性的原因。

Blockchains can be both public and private. A private blockchain allows each block to be distributed to all computers in the system (i.e., Bitcoin). In contrast, private blockchains may have one or a few trusted organizations that hold the ledger. In the current environment, central banks and nation-states are much more interested in creating private blockchains or private DLTs (distributed ledger) to create Central Bank Digital Currencies (CBDC). In recent years, Singapore has shown increasing interest in blockchain technology and has begun to fund a blockchain program called Singapore Blockchain Innovation Program. Singapore is generally crypto-friendly but has in recent months warned its retail investors to trade with “extreme caution” when investing in Cryptocurrency. This warning came following record-high bitcoin prices and market capitalization for the cryptocurrency market.

區塊鏈既可以是公共的,也可以是私有的。私有區塊鏈允許將每個區塊分發到系統中所有的計算機(即比特幣),而私有區塊鏈可能有一個或幾個受信任的組織來持有分類賬。在當前環境下,中央銀行和民族國家對通過創建私有區塊鍊或私有 DLT(分佈式賬本)來創建中央銀行數字貨幣(CBDC)更感興趣。近年來,新加坡對區塊鏈技術表現出越來越濃厚的興趣,並開始資助一項名為新加坡區塊鏈創新計劃的區塊鏈計劃。新加坡通常對加密貨幣持友好態度,但最近幾個月新加坡政府警告其散戶投資者在投資加密貨幣時要“極其謹慎”進行交易,這一警告是在比特幣價格和加密貨幣市場市值創下歷史新高之後發出的。

This report will dive into Fintech companies in Singapore and analyze their blockchain utilization and see if this new business area will continue to thrive in the future or if tighter regulation and legislation will halt this booming industry.

本報告將深入探討新加坡的金融科技公司,分析它們的區塊鏈使用情況,看看這個新的業務領域是否會在未來繼續蓬勃發展,或者更嚴格的監管和立法是否會阻止這個蓬勃發展的行業。

2

Blockchain in Singapore

新加坡的區塊鏈技術

Regarding the construction of blockchain companies, various questions have attracted the special attention of experts in Singapore. This paper combines the feedback from Singapore accounting, tax law, and audit experts to put forward professional opinions from the perspective of industry, finance, and tax to address common misconceptions and guide the industry's healthy development.

關於區塊鏈公司的建設,各種問題引起了新加坡專家的特別關注。本文結合新加坡會計、稅法、審計專家的反饋意見,從行業、金融、財稅的角度提出專業意見,解決普遍存在的誤區,引導行業健康發展。

In early 2017, the blockchain projects Ethereum Asia Pacific Ltd. and Litecoin Foundation Ltd. successively established a public security company limited in Singapore as a non-profit foundation to manage the global community operations of its open-source projects. Since then, many token-issuance projects have followed similar practices, registering similar structures in Singapore and operating their token issuance from Singapore as a base.

在 2017 年初,區塊鏈項目Ethereum Asia Pacific Ltd.和Litecoin Foundation Ltd.先後在新加坡成立了公共安全有限公司,作為非營利基金會管理其開源項目的全球社區運營。從那時起,許多代幣發行項目都遵循了類似的做法,在新加坡註冊了類似的結構,並以新加坡為基礎進行了代幣發行。

Compared with the high cost, physical distance, and operation difficulty of a Swiss foundation, Singapore non-profit public guarantee company limited is appealing to the global blockchain movement, especially in Asia, with its simple governance structure and standardized registration process, and this type of organization has become unique to the token issuing industry. Singapore is, in addition, a politically and economically stable country with a strong rule of law, a somewhat rarity in the Asian business environment.

與瑞士基金會的高成本、遠物理距離和高運營難度相比,新加坡非營利公共擔保有限公司以其簡單的治理結構和規範的註冊流程吸引了全球尤其是亞洲的區塊鏈運動。這種類型的組織在代幣發行行業中是非常獨特的。此外,新加坡還是一個政治和經濟穩定、法治強的國家,這在亞洲商業環境中是很少見的。

The rapid development of the industry has also made blockchain consulting one of the largest business opportunities in Singapore of the year. Although Singapore is under certain policy guidance and supervision regarding token issuance, the Monetary Authority of Singapore is friendly to non-securities. However, as with all new technologies, there are still many uncertainties and unknowns regarding regulation. In addition to this, media attention is also exploding. A lack of trustworthy expert information brings great potential risks to overseas investors who might not be familiar with either the technology or the current business environment/risk.

行業的快速發展也讓區塊鏈諮詢成為新加坡今年最大的商機之一。雖然新加坡在代幣發行方面有一定的政策指導和監管,但新加坡金融管理局對非證券代幣發行持友好態度。然而,與所有新技術一樣,監管方面仍然存在許多不確定性和未知數。除此之外,媒體的關注度也在爆炸式增長,缺乏可信賴的專家信息給可能不熟悉技術或當前商業環境/風險的海外投資者帶來巨大的潛在風險。

The industry, regulatory, and related professional services are very new. For consulting and licensed professional service providers engaged in token issuance in such an environment, making sure always to maintain professional ethics and a humble attitude of "knowing what they do not know" fully understand the practical problems of new industry practice, analyze new phenomena with professional experience, research new ideas, and problems, stimulate and participate in the discussion of regulatory authorities and industry norm making are the most important professional ethics for all professional practitioners and will bring the most practical value to the project side. For all professional service providers, the main trait we seek to avoid is "conclusion" in the current Singapore blockchain industry, which is also in line with the basic principles of Singapore government policy supervision.

行業、監管和相關專業服務處於一個初級階段。對於在這樣的環境下從事代幣發行的諮詢和持牌專業服務商,一定要始終保持職業道德和“知其不知”的謙虛態度,充分理解新行業實踐中的實際問題,分析新現象具有專業經驗,研究新思路和新問題,激發和參與監管部門的討論和行業規範的製定,是所有專業從業者最重要的職業道德,會給項目方帶來最實用的價值。對於所有專業服務商來說,我們在當前新加坡區塊鏈行業中尋求避免的主要特徵是“結論”,這也符合新加坡政府政策監管的基本原則。

The following trending topics based on the practices of the Singapore regulatory industry and experts are summarized at this stage for consideration:

現階段根據新加坡監管行業和專家的實踐,總結了以下趨勢主題以供考慮:

Is the token issuer using a non-profit "foundation" or a "general limited company"?

代幣發行者是使用非營利“基金會”還是“一般有限公司”?Token issue: is it an offshore company holding a Singapore entity or a Singapore entity holding an offshore company?

代幣發行:是離岸公司持有新加坡實體還是新加坡實體持有離岸公司?How can liquidity issues be handled after the token issue is completed without violations? How to deal with accounting work and audit problems?

在不違規的情況下,代幣發行完成後如何處理流動性問題?如何處理會計工作和審計問題?

Each one of these trending topics will now be analyzed in further detail to derive the truth behind these often complicated and interlocking challenges.

現在將進一步詳細分析以上每一個熱門話題,來推導出這些通常複雜且相互關聯的挑戰背後的真相。

2

Token Issuing In Singapore

在新加坡發行代幣

Is the token issuer using a non-profit "foundation" or a "general limited company"?

代幣發行者是使用非營利“基金會”還是“一般有限公司”?

Firstly, there is no special requirement on the official regulatory level to issue tokens with any entity of any nature: it is like doing any business. If your customers are willing to believe you, sign a contract with you, and pay the money to your personal account, the transaction can happen normally; if there is no issuing entity, the project sponsor signs as the issuer in the name of an individual, and takes unlimited responsibility with his / her digital wallet and bank account. If all the token investors agree, the issuance of the token can also be completed; The reality is that the token issue project itself should be a business and a team project, which needs to be organized and operated in a long-term and regular way in the form of company and be supervised by the company law; whether they are willing to operate regularly and accept supervision is to be decided by the sponsor of the project. Overall, there is no regulatory requirement on what legal entities are or are not allowed to tokenize their products or services. Both foundations and limited companies can be used in this process.

首先,官方監管層面對任何性質的任何實體發行代幣沒有特別要求:就像做任何生意一樣。如果您的客戶願意相信您,與您簽訂合同,並將款項打到您的個人賬戶,交易就可以正常進行;如果沒有發行實體,項目發起人以個人名義作為發行人簽署,並對其數字錢包和銀行賬戶承擔無限責任。如果所有代幣投資者都同意,也可以完成代幣的發行;現實情況是,代幣發行項目本身應該是一個業務和團隊項目,需要以公司形式長期定期組織運營,並受公司法監管;是否願意正常經營並接受監督,由項目發起人決定。總體而言,對於哪些法律實體允許或不允許對其產品或服務進行代幣化沒有監管要求,代幣發行者可以選擇使用非營利“基金會”或者“一般有限公司”。

Based on the above, whether the non-profit entity or the for-profit subject is used for token issuance can also be said to be the independent decision of the project party. First, the core difference between the two is that the non-profit public security limited company (Foundation) has no shareholders and only members. Therefore, there are no dividends or holdings. The income can only be used for project expenditures that meet the company's established objectives, and an annual audit report is required. The for-profit company shall determine the ownership of the company's assets according to the number of shares of shareholders and may pay a dividend. From the perspective of industry practice, the projects described in the white paper are all descriptions of future events (not yet occurring at present). The token funds invested by token investors to the project party are used to develop the project. The assets are not owned by the project team or any individual but managed by the project team on behalf of all investors. To use the non-profit foundation as the main body, the non-profit governance structure and operation rules are more suitable for token issuance's nature and management needs. They can more reasonably manage the funds donated by the whole community to be used for the future development of the project described in the white paper.

綜上所述,無論選擇非營利實體還是營利主體來進行代幣發行,都由項目方獨立決定。首先,兩者的核心區別在於非營利性公安有限公司(Foundation)沒有股東,只有成員。因此,沒有股息或持股。收入只能用於滿足公司既定目標的項目支出,並需要提供年度審計報告。營利性公司應當根據股東的股份數量確定公司資產的歸屬,並可以支付股利。從行業實踐來看,白皮書中描述的項目都是對未來事件的描述(目前尚未發生)。代幣投資者向項目方投入的代幣資金用於項目未來的發展。資產不屬於項目團隊或任何個人所有,而是由項目團隊代表所有投資者進行管理。以非營利基金會為主體,非營利的治理結構和運作規則更符合代幣發行的性質和管理需要,可以更合理地管理全社區捐贈的、用於白皮書中描述該項目未來發展的資金。

In other words, the operation of token issuance by non-profit institutions is such that self-governance is more important than the other requirements, and the most important part is ignored: industry practice, which is separated from the understanding and practical experience of blockchain industry, and the judgment and suggestions are given from the legal and corporate structure level.

對於非營利機構發行代幣的運作來說,自治比其他要求更重要,且最重要的部分被忽略了:行業實踐,這是脫離了對區塊鏈的理解和實踐經驗行業,並從法律和公司結構層面給出判斷和建議。

Token issue: is it an offshore company holding a Singapore entity or a Singapore entity holding an offshore company?

代幣發行:是離岸公司持有新加坡實體還是新加坡實體持有離岸公司?

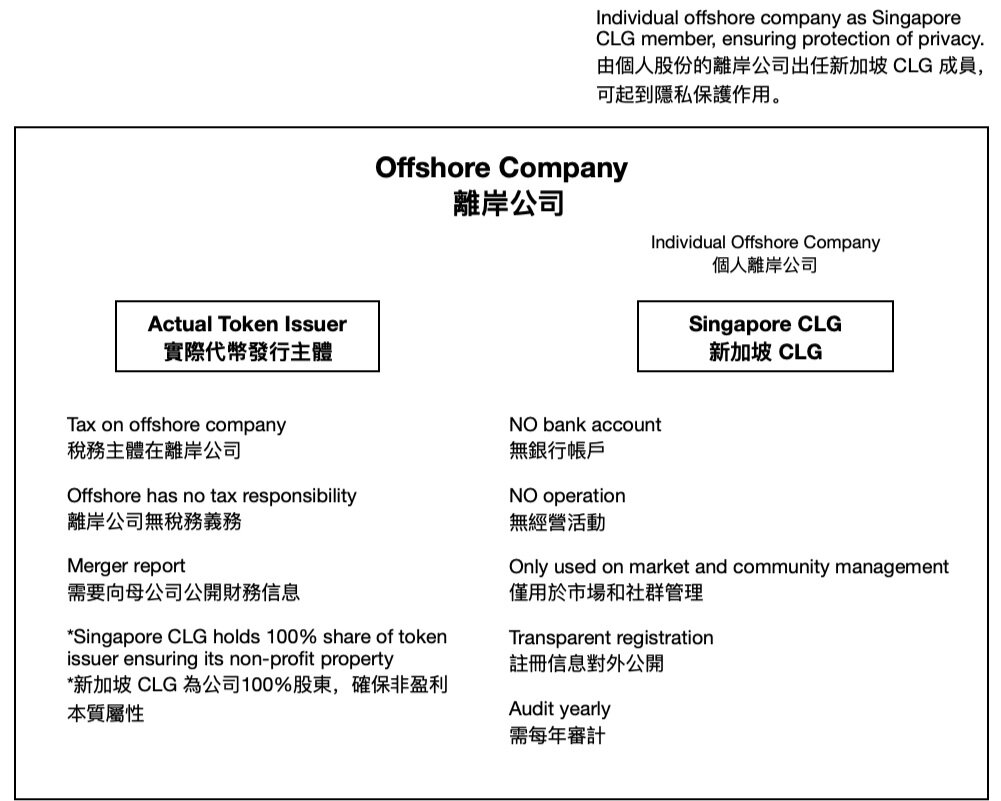

The main role of offshore companies in token issuing structures is a privacy protection and tax planning. The comparison between the two different holding structures can be found on the left.

離岸公司在代幣發行結構中的主要作用是隱私保護和稅收籌劃。可以在右側找到兩種不同保持結構之間的比較。

The logic is simple: the subject to issue currency should obey the country's tax system where the subject is located. This is not associated with whether the shareholder is in an offshore company. Here, there are often questions from the project party whether the offshore entity can issue currency directly. The answer to this refers to the discussion on topic 1. The basic point of view is the same: the choice of self-governance mode is the operational decision of the project party( Note: in figure 2, Singapore Private Limited is controlled by offshore entities, and bank opening of Singapore company has a high risk of rejection.)

道理很簡單:發行貨幣的主體要服從主體所在國的稅收制度。這與股東是否在離岸公司無關。在這裡,項目方經常會質疑離岸實體是否可以直接發行貨幣。答案參考主題1的討論。 基本觀點相同:自治模式的選擇是項目方的經營決策(注:圖2中私人有限公司由離岸控股)實體,而新加坡公司開銀行被拒的風險很高。

How can liquidity issues be handled after the token issue is completed without violations? How to deal with accounting work and audit problems?

代幣發行完成後沒有違規如何處理流動性問題?如何處理會計工作和審計問題?

The Monetary Authority of Singapore supports and encourages financial innovation, and Singapore remains the most friendly international financial center in the onshore countries to the digital currency industry. The main problems encountered at the bank level are all the same. The large amount of funds recorded in the accounts has caused the bank to warn. This can often lead to AML/KYC issues where banks are reluctant to deal with these businesses. In the later operation of token issuance, four major problems need to be carefully treated:

新加坡金融管理局支持和鼓勵金融創新,新加坡仍然是在岸國家對數字貨幣行業最友好的國際金融中心。銀行層面遇到的主要問題都是一樣的。賬戶中記錄的大量資金已引起銀行警告,這通常會導致銀行不願處理此類業務的 AML/KYC 問題。在代幣發行的後期操作中,需要認真對待四大問題:

The choice of the country where the operating entity is located: the company tax of the country should be considered, and the degree of friendliness and policy trend of the digital currency should be considered.

運營實體所在國家的選擇:要考慮該國的公司稅,還要考慮數字貨幣的友好程度和政策趨勢。The operation subject should obtain professional account opening guidance to avoid rejection.

操作主體應獲得專業的開戶指導,以免被拒。Compliance operation in the process of token realization: try to conduct transactions with the compliant trading partner (licensed exchange or institutional OTC) to avoid the company's bank account being closed due to unknown capital sources.

代幣變現過程中的合規操作:盡量與合規交易夥伴(持牌交易所或機構OTC)進行交易,避免公司銀行賬戶因資金來源不明而被關閉。Daily financial and tax work regarding operations, obtain professional service guidance in time, and strictly carry out daily accounting and tax audit reports.

日常財務稅務工作,及時獲得專業服務指導,嚴格執行日常會計和稅務審計報告。

These four problems require careful consideration and close communication with monetary authorities to resolve potential conflicts immediately.

這四個問題需要仔細考慮並與貨幣當局密切溝通,以便立即解決潛在的矛盾。

The business environment in Singapore is adept for blockchain companies and token issuance due to its relatively relaxed regulatory environment and government support for innovative technologies. However, the challenges discussed above must be resolved in an orderly manner before a blockchain or cryptocurrency company in Singapore can thrive. Additionally, much work remains to be done by regulators and the government. However, with careful guidance and lobbying from industry and business leaders, Singapore can become a world-leading center for blockchain and cryptocurrency development.

由於其相對寬鬆的監管環境以及政府對創新技術的支持,新加坡的商業環境非常適合區塊鏈公司和代幣發行。然而,在新加坡的區塊鍊或加密貨幣公司能夠蓬勃發展之前,必須以有序的方式解決上述挑戰。此外,監管機構和政府還有很多工作要做,但是,在行業和商業領袖的精心指導和遊說下,新加坡有潛力成為世界領先的區塊鍊和加密貨幣開發中心。