All-Solid-State Thin-Film Battery - 全固態薄膜電池

Director 指揮 : KEITH YUNXI ZHU 朱耘希

Supervisor 監視 : Oliver Niles White 懷特 尼爾斯 奧立佛

Co-Authors 作者 : Yichang Lu, Runzhou Chen, Xiaobei Chen

Proofread 校對 : Matilde Molinari Giglietti

PURPOSE OF DOCUMENT

文檔目的

The project of “All-Solid-State Thin-Film Battery” is a related project of “Greater Bay Area Nansha Industrial Park” by KEITH & EVEN GROUP in 2021. In this case study, we illustrate the potential value of TFB technology and the process/benefits of financing this project. We are committed to providing completed and in-depth information on project feasibility, profitability, risk, and investment guidance.

此“全固態薄膜電池”案例是奕資有限公司在2021年“粵港澳大灣區南沙工業園區”的有關項目。研究旨在說明薄膜電池技術的潛在價值,以及為該項目融資的過程好處。在此案例研究中,我們致力於為投資者提供完整,深入的項目可行性分析,盈利能力,風險和投資指南信息。

COMPANY STATEMENT

公司聲明

Being capable of solving the safety problems of existing liquid lithium batteries, the all-solid-state thin-film batteries (TFB) will subvert the existing lithium-ion battery market, ultimately creating enormous value. Accordingly, we at THE KEITH & EVEN GROUP are glad to analyze this case of one of our clients for those interested.

全固態鋰電池能夠從根本上解決現有液態鋰電池的安全問題,它將顛覆現有的鋰離子電池市場,並創造巨大的價值。因此,我們奕資有限公司很高興為感興趣的投資者介紹我們客戶的項目。

1

Case Overview

案例概要

The establishment of the GBA is an initiative of the Chinese central government, and its strategic policies include developing technology and streamlining the financial system and infrastructure. As an industrial park located in the center of GBA, one of the focuses of the Nansha Industrial Park is producing all-solid-state Thin Film lithium Batteries (TFB). Moreover, this industrial park not only has intersected with the mineral resources from Zhaoqing to Hong Kong but has also built trade relations across Europe, America, and Southeast Asia. The government of Nansha provides generous incentives to investors in the region, which offers unique development opportunities for industries in the GBA.

粵港澳大灣區在中國中央政府的倡議下成立,其戰畧政策包括發展科技、精簡金融體系和基礎設施。南沙工業園區是位於大灣區的工業園區,生產全固態薄膜鋰電池是南沙工業園區的重點之一。此外,該工業園區不僅與肇慶至香港的礦產資源相交叉,還與歐美、東南亞建立了貿易關係。南沙政府為該地區的投資者提供了慷慨的獎勵,這為大灣區的產業提供了獨特的發展機會。

Case Background

案例背景

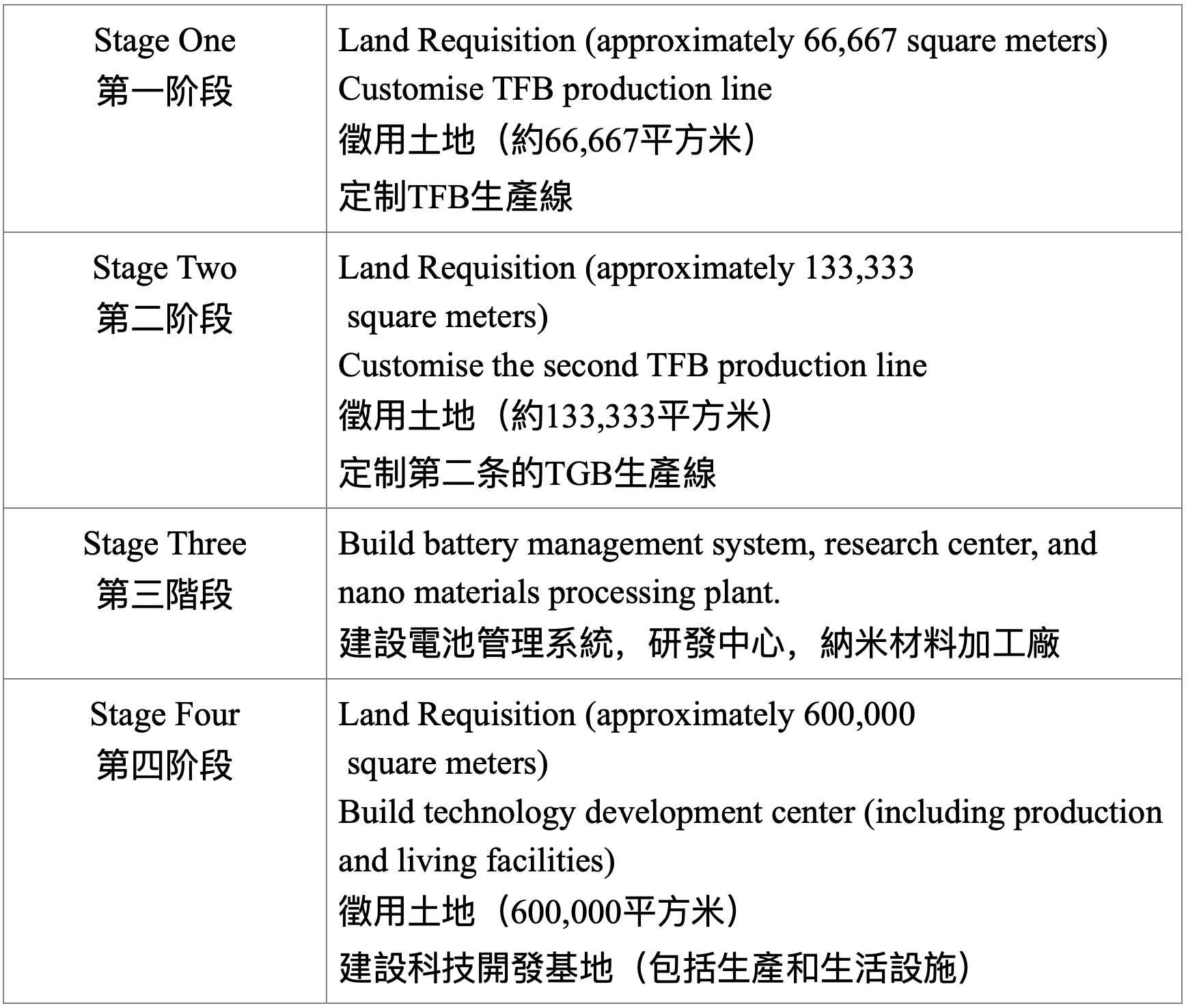

Figure 1: Production Plan

圖一: 生產方案

The rapid development of the Internet of Things (IoT), new energy, aerospace, and military industries have made high-quality and efficient advanced batteries an indispensable component. However, the existing lithium battery technology has encountered bottlenecks in safety, energy density, cycle life, miniaturization, etc., which severely hindered the development of related industries. TFB technology is the ultimate solution of solid-state lithium batteries to technical defects. This technology will fully replace the existing lithium battery technology to become a post-lithium battery technology: application areas and market prospects. However, due to its high cost and confidentiality, it is hard to commercialize, result in only 3--4 production lines running across the world.

物聯網、新能源、航太航空和軍工領域的飛速發展,使優質高效的先進電池成為不可缺少的基礎元件。然而,現有鋰電池技術在安全性、能量密度、循環壽命、微型化等方面均遇到瓶頸,嚴重阻礙了相關產業的發展。薄膜電池是固態鋰電池的終極技術方案,它將解決現有鋰電池的技術缺陷和潛在問題,可全面替代現有鋰電池技術成為后鋰電池技術,擁有廣泛的應用領域和市場前景。但是其成本非常高,且技術保密,無法實現商業化,導致現在全世界只有3-4條生產線。

With the support of international professionals and manufacturers, our client completed the assembly of the 140mm x 140mm micro battery automated production line and the design demonstration of the 0.5m x 0.5m high-current battery automatic high-speed production line. At the same time, they constantly improve the TFB production line process to reduce costs. Our client's TFB production line cost is 20% to 50% lower than that of the United States and Japan. Our client's specific production plan is shown in Figure 1 above。Our client's technology roadmap as shown in the Figure 2 above.

我們的客戶在國際專業團隊和設備廠商的支持下,完成了140mm x 140mm 微電池自動生產線的組配和 0.5m x 0.5m 大電流電池全自動高速生產線的設計論證。同时不斷完善薄膜電池的生產線工藝以降低成本。我們客戶的薄膜電池生產線成本與美國、日本相比低 20%到50%。我們客戶具體的生產方案如圖一所示。我們客戶的技術路線如圖二所示

Figure 2: Technology Roadmap

圖二: 技術路線

The TFB production line conforms to the concept of sustainable development and is an environmentally friendly high-tech project. No production wastewater, harmful gases, and waste residues will be discharged. Water/air pollution and solid waste will not be caused. The production line will not produce noise and will not cause acoustic pollution. At the same time, our client will be equipped with corresponding energy supply and energy-saving measures.

薄膜電池生產線符合可持續發展的理念,屬於環保型高科技專案。生產過程中沒有生產廢水、有害氣體和廢渣排放,不會造成水污染、空氣污染和固體廢物污染。生產線不會產生噪音,不會造成聲污染。同時,我們的客戶配備了相應的能源供應與節能措施。

Project Status

項目現狀

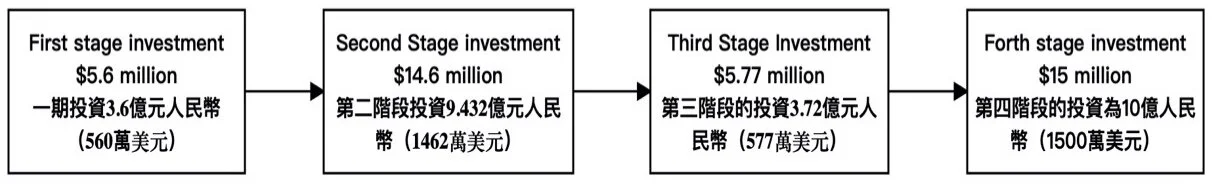

The project plan is divided into four phases. In each phase, the investment scale, construction period, and land scale are shown in the following Table 1:

目規劃分為四期,各期的投資規模、建設週期和用地規模如下表一所示:

Table 1: General Project Plan

表一: 項目總體規劃

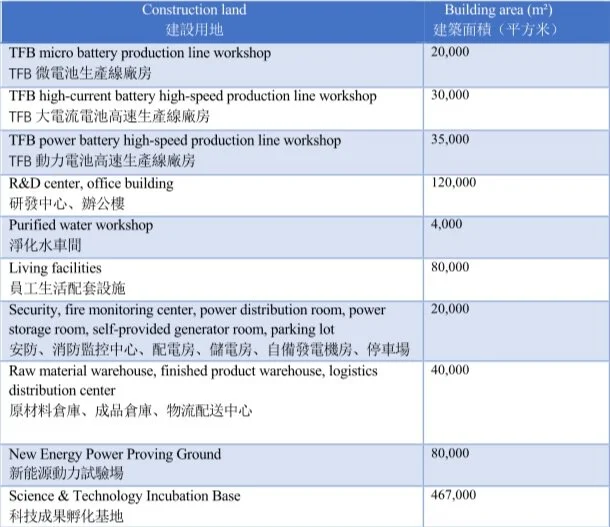

Calculated with the construction land plot ratio of 0.9 in the development zone, the total construction area is about 900,000 square meters. The specific plan is shown in the following Table 2:

以開發區建設用地容積率 0.9 計算,總建築面積約 90 萬平方米,具體規劃如下表二所示。

Table 2: Specific Planning of Project Construction Land

表二: 項目建設用地具體規劃

To this day, the project has been reviewed by experts from the Guangqing Industrial Park Management Committee (see Appendix 1: Expert Review Opinion Form for Guangqing Industrial Park Project), approved by the Development and Reform Department (see Appendix 2: Guangdong Province Enterprise Investment Project Record Certificate ) and the environmental protection department to make preliminary evaluations and issue opinions (see Appendix 3: Preliminary Opinions on Environmental Evaluation of Guangzhou (Qingyuan) Industrial Transfer Industrial Park).

目前,該項目已經廣清產業園管委會組織專家評審(見附件一:廣清產業園專案專家評審意見表),並由發改部門批准備案(見附件二:廣東省企業投資專案備案證)和環保部門初步評測並出具意見(見附件三:廣州(清遠)產業轉移工業園環境評測的初步意見)。

Expert Team

專家團隊

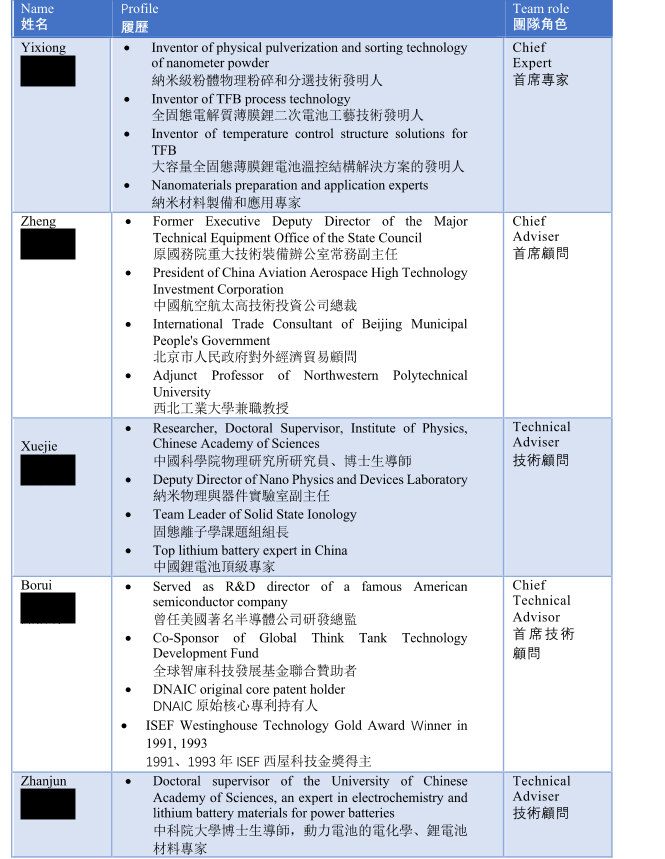

Cooperating with professionals (as shown in Table 3) can also integrate global resources to ensure the operation and subsequent development of the TFB project.

與專業的技術團隊合作(如表三所示),還可根據需要整合全球範圍內的相關資源,保證薄膜電池專案的開發經營和後續發展

Table 3: TFB Experts Team

表3: 薄膜電池專業技術團隊

Meanwhile, our client cooperated with many well-known international strategic agencies (as shown in Table 4) to provide strong support for the development and production.) to provide strong support for the development and production.

同時,我們的客戶與眾多國際知名戰略機構合作(如表四所示),為開發生產提供強有力的支持。

Development Goals and Achievements

發展目標與成就

Table 4: Cooperation Agency

表4 : 合作機構

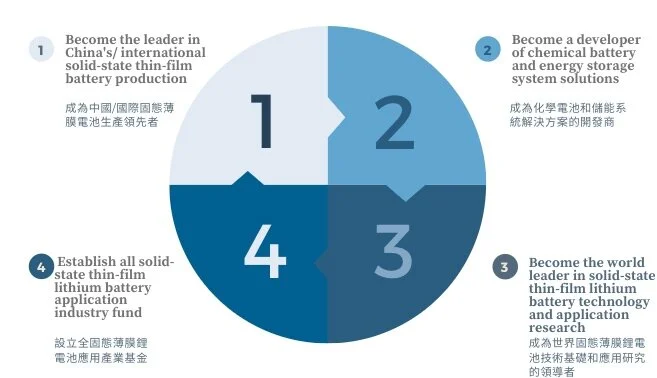

TFB project has four major development goals (Figure 4):

全固態薄膜電池項目具有四大發展目標(圖四):

To this day, our client has made significant achievements in the fields of technology and production. In terms of technical achievements, our client has mastered 4 core technologies related to the development and production of TFB:

目前,我們的客戶在技術和生產方面取得重大成就。技術成就方面,我們的客戶掌握了四項有關開發生產薄膜電池的核心技術:

Physical crushing and sorting technology of nano-scale materials

納米級材料的物理粉碎和分選技術Production technology of TFB

TFB的製備技術Large-capacity TFB temperature control technology (patent number: 201310207926.3)

大容量全固態鋰電池控溫技術(專利號:201310207926.3)Graphene electrode preparation technology

石墨烯電極製備技術

Our client has completed the assembly of a fully automated solid-state thin-film lithium battery production line and a battery management system product line and has produced a certain number of samples in an industrialized mode in terms of production achievements.

生產成就方面,我們的客戶已經完成了全自動固態薄膜鋰電池生產線及電池管理系統生產線的組配,並以產業化模式生產出了一定數量的樣品。

2

Business Opportunities & Risks

商業機遇與風險

Market Situation

市場現狀

Currently, polymer lithium batteries have significant technical problems such as low conductivity and poor safety. To solve these problems, inorganic solid electrolytes are the best solution. Inorganic solid electrolytes can effectively increase the conductivity of lithium ions so that the lithium battery achieves an ideal working state. In addition, TFB is made of inorganic solid materials, which have solid durability to high and low temperature, therefore has high safety.

目前市場上廣泛使用的聚合物鋰電池存在導電率低、安全性較差等重大技術問題。 要解決這些重大技術問題,只有採用無機固態電解質。 無機固態電解質能有效加大鋰離子的傳導率,從而使鋰電池達到最理想的工作狀態。另外,薄膜電池為無機類固體材料製成,對高低溫適應性強,不易燃燒凍裂,安全性高。

The micro version of TFB has already been produced in small batches in the United States, Japan, and South Korea; the US military enterprise and Toyota Japan have few testing production lines. However, due to the complexity of the production process, high R&D costs, low equipment efficiency, and high manufacturing costs, it has never been industrialized. As a result, the market demand is vast and urgent, while the products are short supply.

薄膜電池中的微型電池已在美國、日本和韓國實現小批量生產;美國軍方企業、日本豐田公司有試驗用小量生產線。 但由於工藝複雜、研發費用大、設備生產效率低,製造成本高企等原因,導致其在大電流電池的產業化方面一直未有突破。從而形成了市場需求巨大、急迫,而產品供不應求甚至無法供應的現狀。

Demand Forecast

需求預測

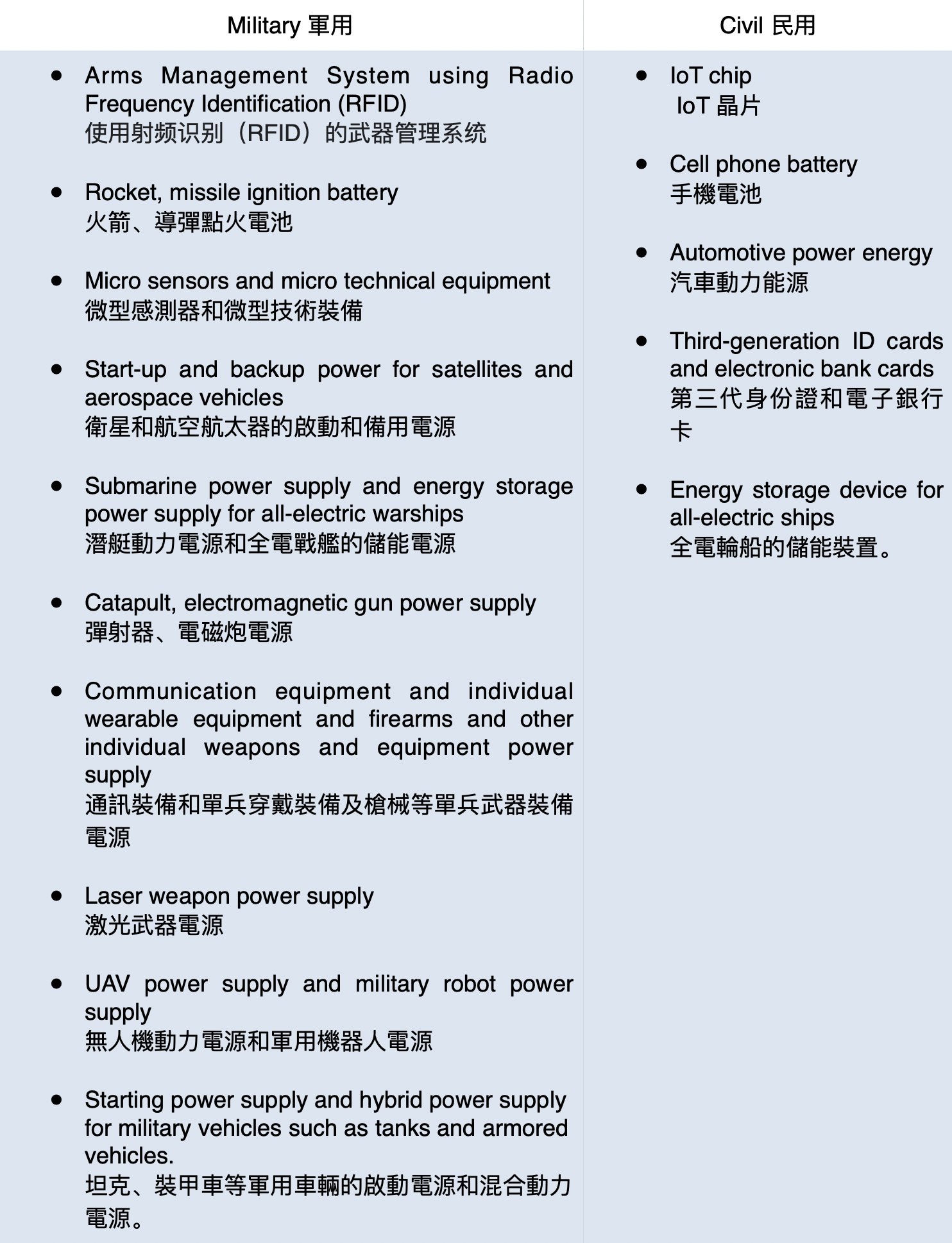

Table 5: Market Application

表 5 :市場應用

According to the research report published by a market research authority, the global lithium battery market has now reached more than one trillion US dollars. With the development of electric vehicles and energy storage devices, the market demand will increase rapidly. At present, China's investment in the field of lithium batteries has reached hundreds of billions of CNY, and its production capacity has reached more than 60% of the world's production capacity. However, due to technical reasons, most of its production capacity can only be used in 3C products. The capacity that can be used in power batteries is less than 1/3 of the total production capacity, and in the field of micro-batteries, there has almost no capacity. The following classification description can illustrate that TFB is in short supply in the high-end market.

據市場研究權威機構發表的研究報告預測,現在全球鋰電池市場規模已達萬億美元以上,隨著電動汽車和儲能裝置的發展,市場的需求量還會迅速增加。 目前,中國在鋰電池領域的投資達幾千億元人民幣,其產能已經達到世界產能的60%以上,但由於技術的原因,大半的產能只能在3C的產品上使用,真正能做動力電池的產量,不到總產能1/3,在微電池領域是空白。從以下分類說明中,可見薄膜電池在高端市場供不應求。

Earning Forecast

收益預測

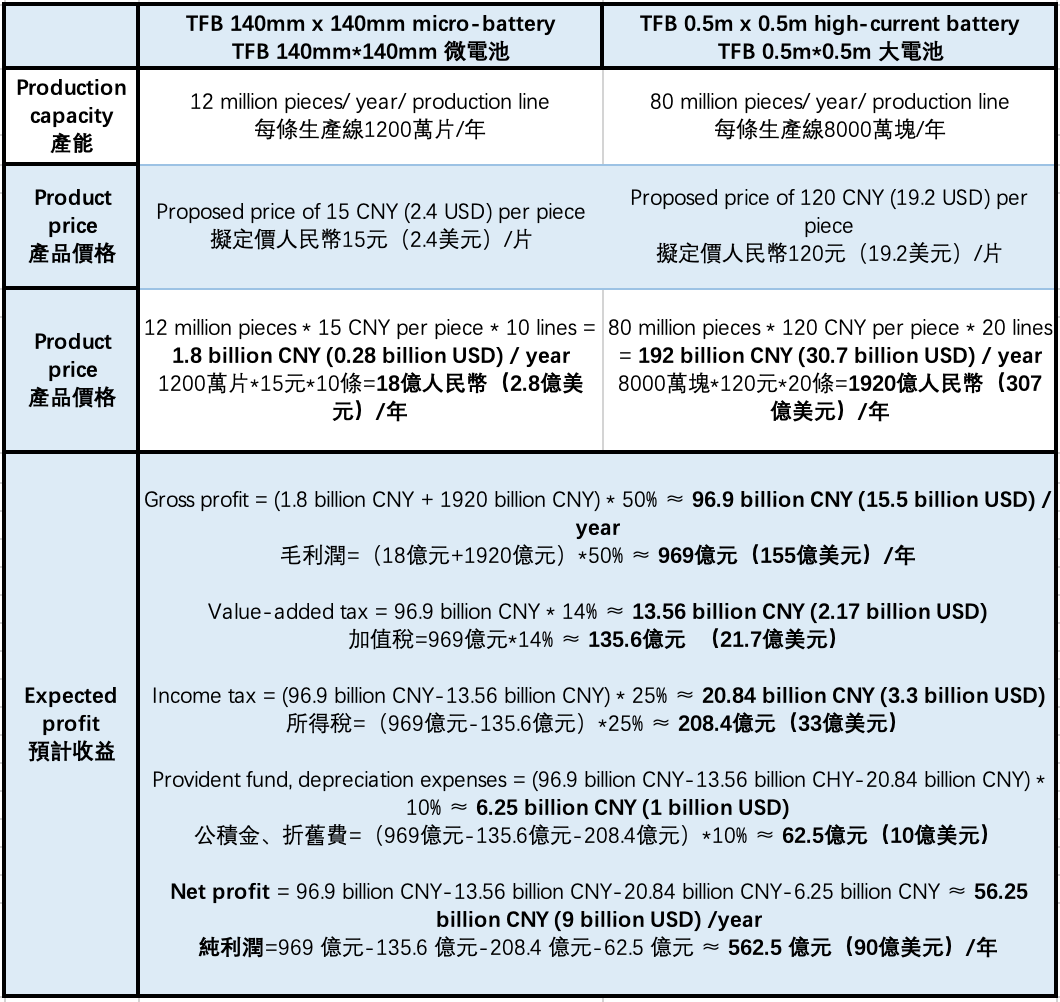

We assume that 10 TFB micro-battery production lines, 10 TFB high-current battery high-speed production lines, and 10 power battery high-speed production lines run in full capacity.

以10條TFB微電池生產線和10條薄膜電池大電流電池高速生產線、10條動力電池高速生產線達產滿產為前提。

Table 6: Earning Forecast

表六: 收益預測

Calculate the annual production capacity, annual output value, and annual profit and tax.

計算年產能、年產值和年利稅。If the production line is reduced, the corresponding annual production capacity, annual output value and annual profits and taxes will be reduced.

如削減生產線則削減相應的年產能、年產值和年利稅。The production capacity of the power battery production line is converted into high-current batteries (mobile phone batteries) to calculate the annual output value and annual profits and taxes.

動力電池生產線的產能換算成大電流電池(手機電池)計算年產值和年利稅。The price of micro-battery is calculated with reference to the price of similar products in the international market; the price of mobile phone batteries is calculated with reference to the price of Apple mobile phone batteries.

微電池價格參考國際市場同類產品價格計算;手機電池參考蘋果手機電池價格計算。Gross profit is calculated at 50% of output value; value-added tax is calculated at 14% of gross profit; income tax is calculated at 25% after value-added tax; provident fund and depreciation are calculated at 10% of after-tax profit.

毛利潤按產值的50%計算;加值稅按毛利潤的14%計算;所得稅按加值稅後的25%計算;公積金、折舊費按稅後利潤的10%計算。Other benefits such as battery management systems are temporarily not included in the scope.

電池管理系統等其他收益暫不列入計算範圍。

Investor Opportunities

投資者機遇

The benefits of investing in TFB are omnifarious

投資TFB的好處是多方面的

This project has remarkable economic benefits since the market is in great demand. Project’s annual expected profit exceeds 50 billion CNY (8 billion USD), while the investment scale is only about 30 billion CNY (4.8 billion USD).

該項目產品經濟效益卓越,市場需求旺盛,每年預期收益超過500億元人民幣(80億美元),而投資規模僅需約300億元人民幣(48億美元)。The project preparation cycle is short, the overall construction cycle only takes roughly 48 months.

項目準備週期較短,整體建設週期僅需約48個月。Low risk in investment, as the production line and samples have already been tested and proved feasible by authoritative institutions such as the Chinese Academy of Sciences.

投資風險低,生產線以及樣品已通過中科院等權威機構檢測並被證實可行。This project has significant social benefits, the product can be widely used in many fields, which can drive a large number of application technologies and industrial upgrades.

社會效益顯著,該產品可廣泛運用於多領域,能帶動大量應用技術和產業升級。

Business Risks

商業風險

Low-Risk Market: The TFB in China is still in the early stage of the experiment and has not yet been industrialized. Therefore, it is conservatively estimated that there will be no competing companies within 2-3 years. After that, our client's product will have been consolidated in the market.

低風險市場:國內全固態薄膜鋰電池目前還處於實驗室階段,大容量全固態薄膜鋰電池均沒有實現產業化生產,因此保守估计 2-3 年內不會有競爭企業,且2-3 年後我們客戶的市場地位已經鞏固。Low Risks in Capacity: Currently, both the military and the civilian market demand new batteries with stronger energy, higher reliability, and a longer-lasting period. There is no concern that market saturation will happen soon. Micro-batteries and terminal batteries can be produced in the early testing and trial phases to avoid the risk of oversupply. Moreover, the profitability is relatively high.

市场需求量無風險:现阶段無論軍用品市場還是民用品市場,都急需大批能量更強、可靠性更高、壽命更長的新型電池。短時間內不存在市場飽和的問題。前期的測試和試驗階段中可以先生產微電池和終端電池,避免壓貨的風險且獲利率也比較高。Low Risk in Profits: According to a market research report published by authorities, the global lithium battery market has now reached more than one trillion U.S. dollars. China alone has invested hundreds of billions of yuans in the field of lithium batteries, and its production capacity has reached more than 60% of the world's total production. The annual output could reach 193.8 billion CNY (31 billion USD), and the profit risk is negligible.

项目收益風險小:據市場研究權威機構發表的研究報告預測,現在全球鋰電池市場規模已達萬億美元以上,中國在鋰電池領域的投資達幾千億元人民幣,其產能已經達到世界產能的 60%以上。本项目年产值可达1938億元(310億美元),收益风险可忽略。

3

TKEG’s Solutions

奕資方案

Market Analysis and Forecast

市場分析及預測

TKEG has extensive experience in private equity and can provide our client with the best market analysis and forecasts.

奕資有限公司在股權私募領域有豐富的經驗,可以為我們的客戶提供市場分析及預測。

Our client has strong technical and strategic support from several institutions to develop and produce TFB, including the Chinese Academy of Sciences, Tsinghua University, Taiwan Semiconductor Manufacturing Company, and Hong Kong University.

我們的客戶擁有開發生產全固態薄膜鋰電池所必須的強有力的技術支撐和戰略合作機構,包括中國科學院,清華大學,台灣半導體製造公司和香港大學 。

This project has a good market prospect, strong demand, strong profitability, good economic benefits, and at the same time, the risk is low. The annual output value of the project is about 193.8 billion CNY (31 billion USD), and the net profit is expected to reach 56.25 billion CNY(8.7 billion USD)per year.

本項目產品市場前景好,需求旺盛,盈利能力強,經濟效益好,同时風險不大,大有可為。项目年產值約為1938億元(310億美元),预计收益纯利润可达562.5 億元/年(87億美元/年)。

This project is a green and environmentally friendly high-tech project with the triple attributes of new energy, new materials, and new technology and is in line with the direction of the sustainable development plan in China.

本專案是綠色環保的高科技專案,同時具備新能源、新材料、新技術三重屬性,符合可持續發展方向。

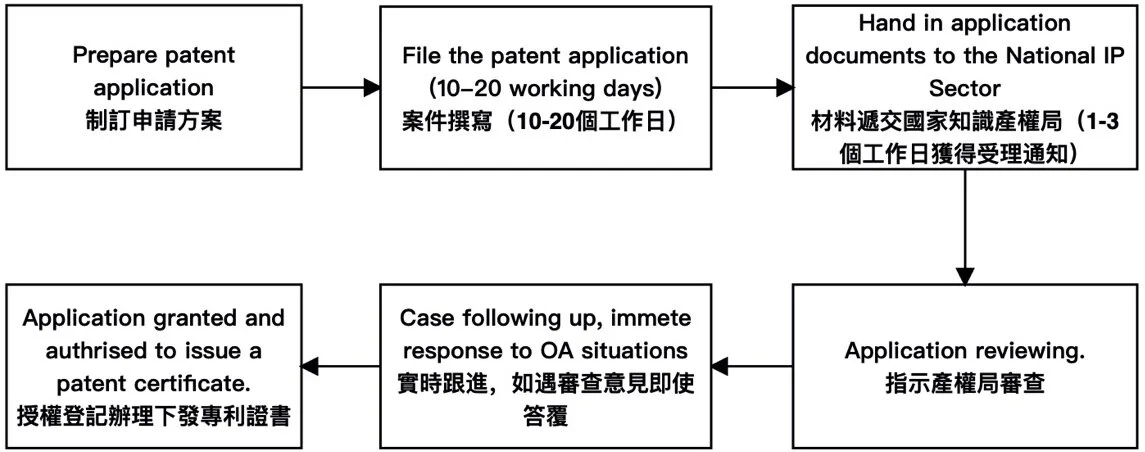

Patent Application Guidance and Evaluation

專利申請指導及評估

The TFB technology does not involve patents of the University of Texas's existing technology. After searching for existing patents in the United States, Japan, Europe, and China, we confirmed that our client's TFB technology does not have any patent risks.

全固態薄膜鋰電池经确认不涉及德州大學現有技術的專利, 经檢索美國、日本、歐洲和中國的專利,我们確認全固態薄膜鋰電池技術不涉及有效專利,因此無專利方面的風險。

TKEG provides professional patent application services. The specific process is shown in figure 5. We promise to follow up on the progress of the applications in real-time and carefully verify all application documents to ensure everything is correct.

奕資提供專業的專利申請服務,具體流程如下圖。我們承諾實時跟進專利申請進度,認真核實各項申請資料,確保萬無一失。

Figure 5: Patent Application

圖五:專利申請示意圖

Technology Risk Assessment

技術風險評估

Technical Assessment: Our client has completed the design and construction and has produced samples. They have completed various tests with the Chinese Academy of Sciences and other authoritative institutions. All the test results have reached the world-leading technical indicators.

技术检测:我們的客戶已完成了生產線的設計和搭建並生產出了樣品,通過中科院等權威機構完成了各種檢測,檢測結果均達到了國際領先的技術指標。Technical Support: Our client has negotiated strategic cooperation with the Chinese Academy of Sciences, supporting experts, technology, and equipment. They also have access to technical supports from top universities and research institutions in the United States and Japan. In this way, our client's products can be continuously improved according to the market's needs and can be in a world’s leading position.

技术支持:我們的客戶已與中科院達成戰略合作意向,由中科院提供人才、技術和實驗設備等支援,還可取得美國、日本相關大學和研究機構技術上的支援。使我們客戶的產品能根據市場的需要不斷改進,始終站在世界領先的地位。Technical Experts Loss: The core members of the technical team are all shareholders of the company. Our client set up an innovative reward system and implement option rewards for experts joining in the future. As well as implement a highly subsidized competition system and using legal means to prevent unfair competition. At the same time, our client has established a developed patent and software service system to avoid loss of technology.

人才流失:核心技术團隊成員均為公司股東。我們的客戶设立創新獎勵的機制,對以後引進的人才實行期權獎勵。實行高補貼的競業制度,用法律手段來防範不正當競爭。 同時,我們的客戶建立了完善的專利和軟體服務體系,防範技術流失。

Investment and Financing Plan Evaluation

投融資方案評估

We summarize the investment timeline (Figure 6) and phased investment plan (Table 7).

奕資總結概括出本項目的投資時間線(圖六)及阶段性投資方案(表七)。

Figure 6: Investment Timeline

圖六:投資時間線

To ensure a smooth investment process, our client raised funds by equity financing. The specific fund-raising plan is as follows:

為保證投資方案的順利進行,我們的客戶擬採取股權融資的方式籌措資金。具體資金籌措方案如下:

Table 7: Investment Plan

圖七:投資方案

Transferred 30% of the project's equity and raised 300 million CNY (4.66 million USD) as the initial capital of phase one. Among them, at least 100 million CNY (1.55 million USD) was in cash (used to customize equipment, purchase raw materials and maintain company operations), and the rest was used for land, factory buildings, and equipment, facilities, and raw materials used on the site.

出讓專案30%的股權,融資3億元(466万美元)作為專案一期的啟動資金。其中至少1億元(155美元)為現金(用於定製設備、購買原材料及維持公司運營),其餘可用於專案選址範圍內的土地、廠房和專案使用的設備、設施、原材料。The funds of phase two would be solved by loan.

專案二期所需的資金由貸款的方式解決。The funds phases three and four would be solved through project profits, deposits, and advance payments

專案三期、四期所需資金,通過專案盈利和產品定金、預付款來解決。

The financing plan combines internal and external financing to meet the needs of the company's development and ensure the success of investment.

融資方案以內源融資和外源融資相結合,滿足了公司發展的資金需求,有助於推進投資方案的順利進行。